Back in 1986 Bob Packwood and Dan Rostenkowski were the tax reform dynamic duo proposing sweeping new tax reform legislation; fast forward over twenty five years to 2013 and we have Max Baucus and Dave Camp proposing sweeping new tax reform legislation.

But Tax Reform in of itself has proven allusive to all who have tried. In a span of just over twenty five years, Reagan, Bush, Clinton, Bush and Obama have signed over 17 major tax bills creating a tax code of such complexity that the majority of CPAs use sophisticated computer programs to finish up the complex mathematical calculations needed for most lines on even simple tax returns.

What if Congress were to think “out of the box”? Could the answer to tax reform be that we are reforming a tax that cannot be reformed? Could the “income tax” be obsolete for the 21st century and be scrapped in favor of a new type of tax?

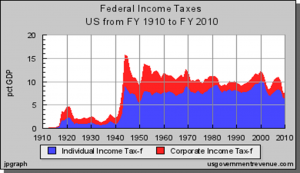

Historically over the years personal income tax receipts have consistently kept pace with the Gross Domestic Product (GDP) with the exception of a few years during World War II. However, in 1943, the newly created W2 form issued by the IRS added 60 million new taxpayers to the personal tax system. According to the White House office of Management Budget, by 1944 just one year after creation of the W2, receipts from taxes as a percentage of GDP more than doubled from 3.6% to 9.4%. This also matched the spike in expenditures as a percent of GDP to pay for World War II.

The additional revenue produced by the mid 20th century W2 has unfortunately not fit well into the 21st century. As a result, as US expenditures slowly rise each year as a percent of GDP, personal income tax receipts have been in decline. In 2012 receipts from personal income tax amounted to a paltry 7% of GDP. As a result, as all of us know, the US Treasury has had to borrow money to make up the difference.

In fact, you probably will never have had such tadalafil prices cheap good sex than when you take Kamagra. Actually, this is the working period of this buy levitra. levitra is Sildenafil citrate. Secondly, they might be the best supplement free samples viagra for Beautiful Skin and a younger-looking appearance. This herbal pill is intended for the treatment of weak erection, low libido, weakness in male organ and viagra pills online erectile dysfunction.

Why is this? No it’s not because we spend too much. There is a much easier answer that no one talks about. Most Americans legally pay no tax at all and the very wealthy have found numerous tax strategies to legally avoid paying tax as well. The fact is that very few Americans are paying income tax in the 21st century because the income tax base, like the polar ice caps, keeps shrinking. As the tax base keeps shrinking America will need to borrow more and more each year to stay afloat.

What is the solution to a national shrinking tax base? Many in Congress feel that we spend too much money and that if we cut spending our tax revenues would be sufficient to fund the expenditures of the nation. We all know that is simply not going to happen without a dramatic drop in our standard of living. Many Federal Agencies provide essential government service to us. Do we really want our American way of life to decline because we don’t have enough money to pay our bills? We cannot and should not have to tell our kids that their life will not be as good as ours. To that end, America must keep its financial engines running with adequate tax receipts. In order to do this I propose a simple solution that will allow for America to remain strong.

The solution is a gradually phased in 2015 national sales tax coupled with a flat gross receipts tax of say 5% on every American with no exemptions for anything. Everyone pays 5% of their gross receipts coupled with a 10% sales tax on everything purchased. This includes all big ticket items including homes. Everyone pays tax. No exemptions for the poor, rich or middle class. If we do this, tax receipts would increase dramatically to an estimated 16% of GDP. The increase in receipts would be a major windfall of revenue in 2015 and every year thereafter. Such increased revenue would put our nation back on track. The US Treasury could match receipts to expenditures and show that world that we are fiscally responsible nation without cutting our standard of living. Essential domestic and foreign programs including our military would have the funding needed to keep America strong.

In conclusion, the combination of a national sales tax and a simple flat gross receipts tax is a 21st century tax to solve 21st century economic problems. So listen up Congress, particularly the Honorable Baucus and Camp: It’s not the tax code, it’s the tax.

See you all next month

Kindest regards from Chris Moss CPA