CPA (SC DC VA CA); ATTORNEY (DC VA); BA, MS Accounting, JD (Georgetown University) Leukemia Ball Founder...Member American Institute of CPAs, Virginia State Bar, Spousal Lifetime Access Trusts Domestic Asset Protection Trusts SLATS DAPTS Family LLC Holding, Estate Plan American Bar Association, South Carolina Association of CPAs, District of Columbia Bar, United States TAX COURT;.United States SUPREME COURT; IRS Appeals United States Court of Appeals for the 4th Circuit, US Tax Court Appeals, Virginia Supreme Court,.IRS Audit Representation; Entertainment law Tax Planning and Strategy, MDDC Medical Multi-discipline practice tax structure, Bullet Proof Tax Preparation, International and off shore Tax Law, Divorce Tax Law Forensic Analysis, Real Estate tax law including tax strategy for Real Estate Professionals, Annual personal Income Tax Tune Up, Annual business structure analysis, Family Limited Partnerships and gift tax returns and strategy. South Carolina office for H Christopher Moss, CPA, 210 Wingo Way, Suite 303, Mount Pleasant SC 29464..Virginia office for Infinite Partnerships, H Christopher Moss, Attorney, 211 N Union St, Suite 100 Alexandria, Va. 22314

Author's posts

May 19

Self-Directed IRAs

Submitted by Chris Moss CPA A self-directed IRA is just what the name implies, you as the investment manager of the IRA determine the investment strategy for the funds. When will you most likely benefit from a self-directed IRA? Perhaps you are 50 yrs. old and just left a job where you and have a 401 K …

Mar 14

Payroll Audits

Routine Payroll audits are conducted each year by the IRS and State revenue agencies to primarily determine if independent contractors should be reclassified as employees. But according to the Wall Street Journal not only is the IRS increasing their “crackdown” on small business, but “more small businesses are finding that independent contractors are essential to …

Feb 01

WW II vs Form W2

The Humble W2 Days after President Roosevelt signed into law the “Current Tax Payment Act of 1943” 60 million Americans were instantly introduced to withholding on wages. Forced withholding was sold to the American people as a war-time emergency, a temporary radical loss of freedom to collect maximum revenue from the maximum number of taxpayers. How dramatic was …

Jan 01

State Income Tax Reform

There has been a lot of discussion by State revenue departments lately about how income tax reform at the Federal level will have uneven and unpredictable effects at the State level. However, some savvy proactive States have dramatically lowered income tax or eliminated income tax entirely. These tax-free States are years ahead of the Federal …

Dec 02

Cost Segregation

Cost Segregation is a tax savings strategy that in my view defies logic. The underlying theory supporting Cost Segregation is at best a stretch of the truth, and at worst, an outright deception. Yet the US Tax Court decided in a 116 page July 27, 1997 opinion that Cost Segregation is legal. For those who …

Nov 01

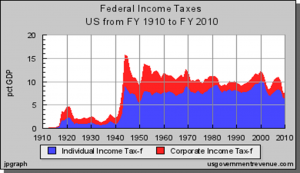

Economics of Tax

Have you been concerned over the rising national debt, now over $16 trillion? Sadly, our children are not as well off as we were. In fact, it appears the 20th century may be on its way to be the Golden Age of American democracy and economic strength. Many politicians say we must cut spending to …

Oct 01

Income Tax Planning and Restructure Analysis

“Restructure Analysis” comes into play during routine individual income tax planning throughout the year. It could involve review of a specific tax position or may include review of multiple tax positions involving interrelated returns over a period of many years. The goal of Restructure Analysis is to rebuild or restructure a tax position to legally …

Sep 01

US Income Tax Code Obsolete

After almost 100 years US income tax collection has evolved into a complex set of laws that very few of us understand. How did this happen? Generally speaking the United States had no permanent income tax until the early 20th century. Collection of the tax was a simple matter and so was the tax law. In those days …

Aug 03

Accounting Shutdown

Would you invest 30% of your income each year in the stock market without you or your broker reviewing financial statements of the businesses you are investing in? But that is exactly what you do when you file your annual Federal income tax return and pay tribute to the US Treasury. You send money to …

Jul 01

Alternative Minimum Tax Nightmare

The Alternative Minimum Tax is never fun. It is, therefore, ironic that the AMT was never thought of by Congress as “not fun”. In fact, the AMT was nothing more than a fun tax the rich scheme back in the day; not all the rich mind you, just a few hundred rich folks that legally paid no tax. It was a …

Jun 01

IRA to ROTH?

I have a very simple mantra when it comes to paying taxes: If you can chose to pay tax now or later, always choose later. For example, if you own a rental property with a low basis, take advantage of Section 1031 and transfer the potential tax liability to an unknown future date by exchanging …

May 02

IRS Audits Are Easy To Survive

IRS Audits are easy to survive. Ok, before you all shoot me, I want to prevent you from being shot. Let’s go over a few basics about the need for good books and records you prepare prior to filing a tax return so you can wear a bulletproof vest and see for yourself how easy …

Apr 17

Tax Reform Magic Act of 2012

As another Tax Day April 17, 2012 rolls by I am always amazed at how complex the United States Tax Code has become. And yes, the Presidential candidates still talk about tax reform in 2012, but can you really take tax reform in 2012 seriously? Some of you may remember the historic Reagan 1986 tax reform …

Dec 15

Cut Government Not Social Security

Did you all know that the most profitable tax the United States has ever had is the social security tax. So much so that in the 1990s President Clinton, with the help of an accounting loophole, borrowed Trillions of dollars of your Social Security money to help balance the budget and create artificial surpluses in …

Nov 07

The Tax Code Is Not the Problem

Jenny Sanford’s thoughtful Ed/Op points out correctly that our tax code is complex. But while the complexity of the tax code can and should be reformed, that is a mere distraction from a true fact that no one seems to want to talk about: Wars and entitlements are very expensive and we have too …